** HOW DO YOU PLAN ACCORDINGLY?? ** YES BUY GOLD / SILVER: ** Because When "Everything" Blows Up, you will be able to sleep at night...

** [ARTICLE REPOST] Unbelievably, the fate of the U.S. economy still rests squarely [ignorantly] on the preservation of stock values and ever more Worldwide Financial Speculation (watch for the coming “Rug Pull”).

A recent report authored by Claudio Borio, Robert McCauley and Patrick McGuire for the Bank for International Settlements (BIS) [they (BIS) give marching orders to the Central Banks of the World {Even the U.S. Fed. Res.}] revealed that the mount of “derivative” debt foreign banks hold is "staggering," according to U.S. Treasury Secretary Janet Yellen (who is the former head of the Federal Reserve {15th Chair from 2014 to 2018}, which important to know moving forward in this article).

How massive is their exposure? The report said, "For banks headquartered outside the United States, dollar debt from these instruments is estimated at $39 trillion, more than double their on-balance sheet dollar debt and more than 10 times their capital."

Financial institutions have not stopped building more complex derivatives to offload risk. Worse, they're offloading it to one another… and even worse, the European banks are surely relying on U.S. banks as counterparties to those derivatives.

A derivative is, fundamentally, something made of nothing. The simplest example is an options contract of a stock. The stock is the underlying asset, and by using the value of that asset and then adding some fancy math to that valuation using time and volatility you get the value of various options.

Here are the top 8 U.S. banks ranked by current volume of derivatives.

Rank Derivatives Bank Name

1 $55,387,209,000,000 JPMorgan Chase Bank

2 $51,794,949,000,000 Goldman Sachs Bank USA

3 $46,562,329,000,000 Citibank

4 $22,087,831,000,000 Bank of America

5 $12,191,517,000,000 Wells Fargo Bank

6 $2,132,802,000,000 State Street Bank and Trust Company

7 $1,516,559,899,000 HSBC Bank USA

8 $1,174,293,000,000 The Bank of New York Mellon

That's over $192 trillion in derivative exposure that we know about, and just for the top eight banks! Not included in this are the other U.S. banks' exposure, nor any exposure to the almost $40 trillion of European bank derivatives. Perhaps this is why shares of Credit Suisse are down near $3 a share [** The Federal Reserve just gave Credit Suisse $9 Billion Dollar bailout 3 Months ago in Oct 2022: (2008 all over again as their Pension Funds investments blew up)].

*** FYI (Read): there are “1202” Other Banks with Exposure to Derivative Trades not on this List Above; Right Now, “you” should be going hmmm….

** [Part of Article] ** If you have your money in a bank, you should be thinking of Will Rogers, who famously said, "I'm not so much interested in the return on my money as I am in the return of my money."

*** STOP RIGHT NOW & READ!! ** The Federal Reserve Chairman (16th Chair) in Charge Right Now After Janet Yellen from 2018--2023 to current is Jerome Powell, and why is this important??

--- Remember, we are talking about Credit Derivative Swaps, etc.. in the banking industry; which the Federal Reserve Oversees, who are also “supposed” to be the Experts, which is why they are there…

** [Quote J. Powell Resume’]: In 1993, Jerome Powell began working as a managing director for Bankers Trust. He left in 1995 after the bank suffered irreparable reputational damage when some complex derivative transactions caused large losses for major corporate clients.

--- According to the Fed. Reserve website: from 1997 (ie., 2 years after he blew up Bankers Trust on bad Derivative Transactions; ie., not knowing what he was doing:

*** Prior to his appointment to the Board [Fed. Reserve], Mr. Powell was a visiting scholar at the Bipartisan Policy Center in Washington, D.C., where he focused on federal and state fiscal issues. From 1997 through 2005, Mr. Powell was a partner at The Carlyle Group (google this group, world elites)

--- And What?? Really, and this Guy is in Charge of the U.S. Economy??? Are you getting the picture yet…??

** CONTINUE ARTICLE: ** Right now you are in a period of manipulated financial assets and should be switching to a period of physical assets. Those who are aware will take action or have taken action to avoid the collapse of financial (paper credit) assets by replacing them with physical assets.

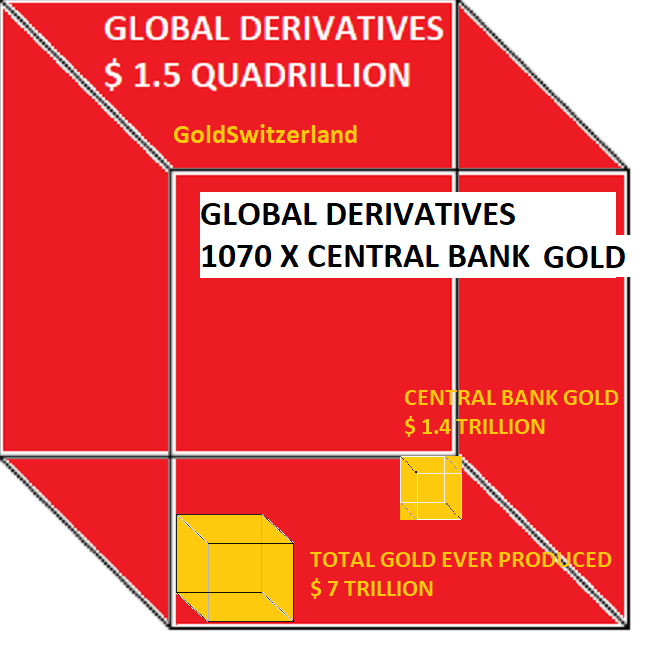

More and more financial assets need to be transferred to physical assets before the crisis becomes acute. We are in a crisis now but it's not yet visible to the people. It should be if they are doing any reading, yet not more than one in 10,000 know the danger almost $300 trillion in derivatives poses.

Government paper, i.e., T-bills and T-notes will be safer for a little longer but the public social mood has been slowly going down over the last year from the peak stock market mania of late 2021 and last New Year, when the Dow peaked at over 36,000. It is very obvious that financial speculation is collapsing. Everything that the Federal Reserve is doing is a futile effort to hold up financial speculation.

It will take focus and alertness to preserve our assets and our quality of life. The financial system, good or bad, is at great risk. Survival for you the individual has never been at greater risk.

The first order of “mental exercise” is to recognize how potentially explosive the financial and social order is. We must have the wisdom to take the information we have and project the future. It is not enough to see the situation as it exists now. Anybody can do this. The wisdom comes with projecting what we see and know into escalating crises of the future so that we are motivated to act [and protect Ourselves with? Yes, Gold & Silver].

We always strive, as above, to detail for you the risks building in the financial system (which Time is Running Out). And we have outlined for you many times the "survival strategies" that work. Now you [need to] must act… to protect you and your families future…

** Call Now: 480-625-1784 and let’s get started in protecting you and your Savings, Investments and Retirement Accounts…